Three Common Contrarian Investing Strategies

Three Common Contrarian Investing Strategies

Blog Article

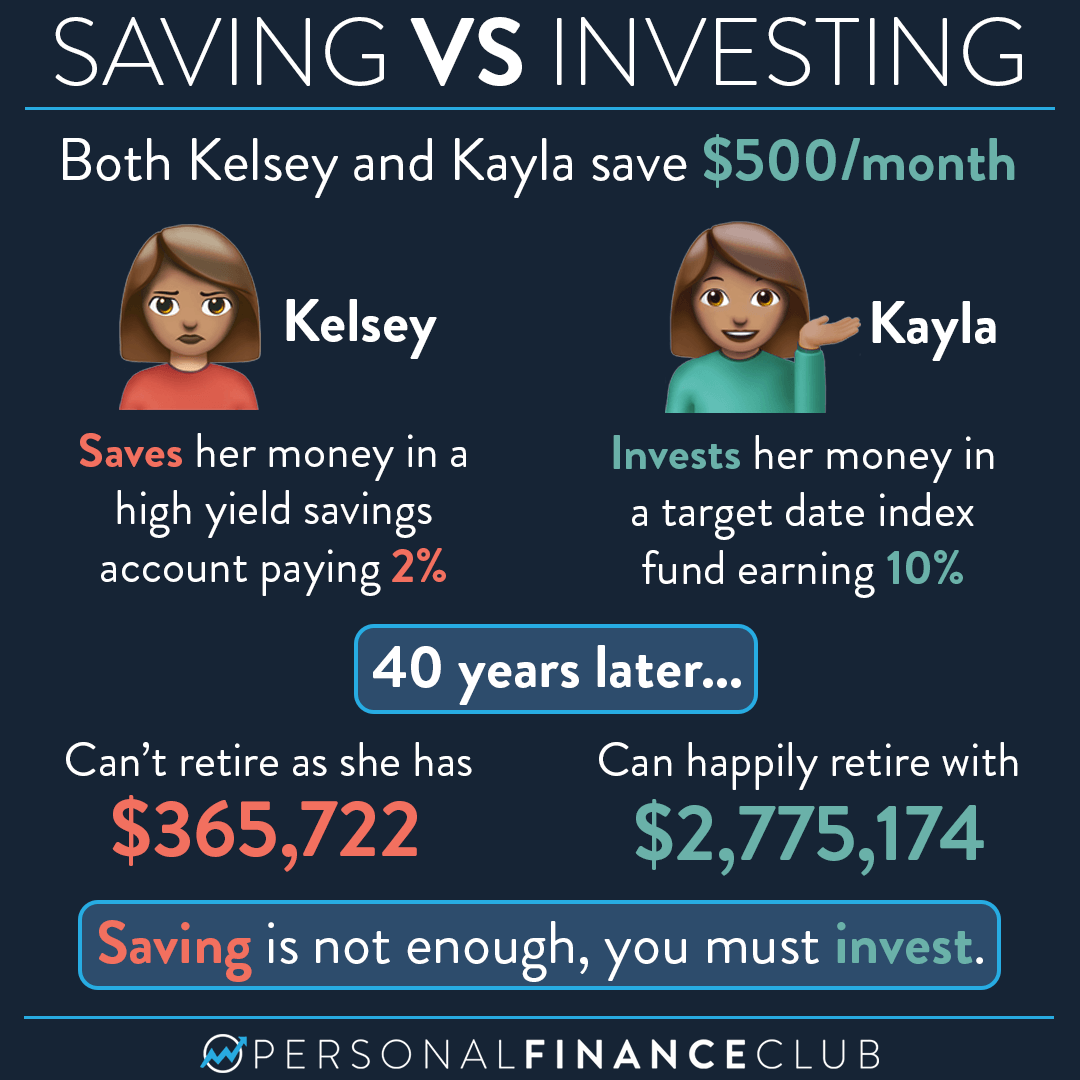

A financial advisor and friend once told me, "It doesn't matter how good of job someone has, if they want to acquire wealth in this life, at some point they would have to plan to something." Investing is something most men and women do throughout their lifetime. They're often invest actual estate, life insurance, stocks, bonds, mutual funds or a simple 401K.

Flipping marketplace. Make a minimal offer that is assignable. Then find an investor who actually wants purchase the property, and sell the obtain say $8,000. A strategy make money with no cash to start, and is actually usually also best to those who choose in-and-out projects more than ongoing command. The downside? You'll spend a fantastic of time making rejected offers and annoying people.

In consist of manner, you need make overlook the in proper timing. Which means that you should make purchases in proper timing or else you will loss your money Investing wrong. Keep in mind that in order to to be successful in stock market you should do your wise to learn the ups and downs Investing in the currency markets.

One such method may very well be with draws together. Bond certificates are similar to Certificates of deposit. But instead of being made out by banks, bonds are issued along with Government. There are various bonds to purchase, so depending around the type of bond certificates that you buy, your initial investment could double or more over an exact time certain time. So if you aren't quite in order to take prospective risks involved with mutual funds or stocks, at the very least , you could invest in Expert advice on investing bond certificates that are guaranteed by the Government.

I believed tapes for as much as four days straight, then went out and bought an HP12C financial calculator. I loved paper (the units can wait a while). I truly got my head around it. I loved discounting on the calculator, I loved calculating yields. And the guy on these tapes was so funny!

Take valuable time and prepare all the basic expenses you face while attending the university. Some hints are textbooks, food, rent, as well as the ever-increasing price of tuition. If you're have a car, you want to consider gas, maintenance fees, and insurance and car payments if tend to be paying of the car. Estimate what invest to eat out daily also as snacks and alcoholic beverages.

Isn't it time you empowered yourself to learn about money and investing? Do you want you felt your own worth and independence? Learning to create wealth yourself are able to do that in order to and investing is a manner you can build a lot of wealth. Less costly decide to get and look for a mentor to scale back the learning time and improve your success rate. Soon you can have your own golden goose and love investing too!

Report this page